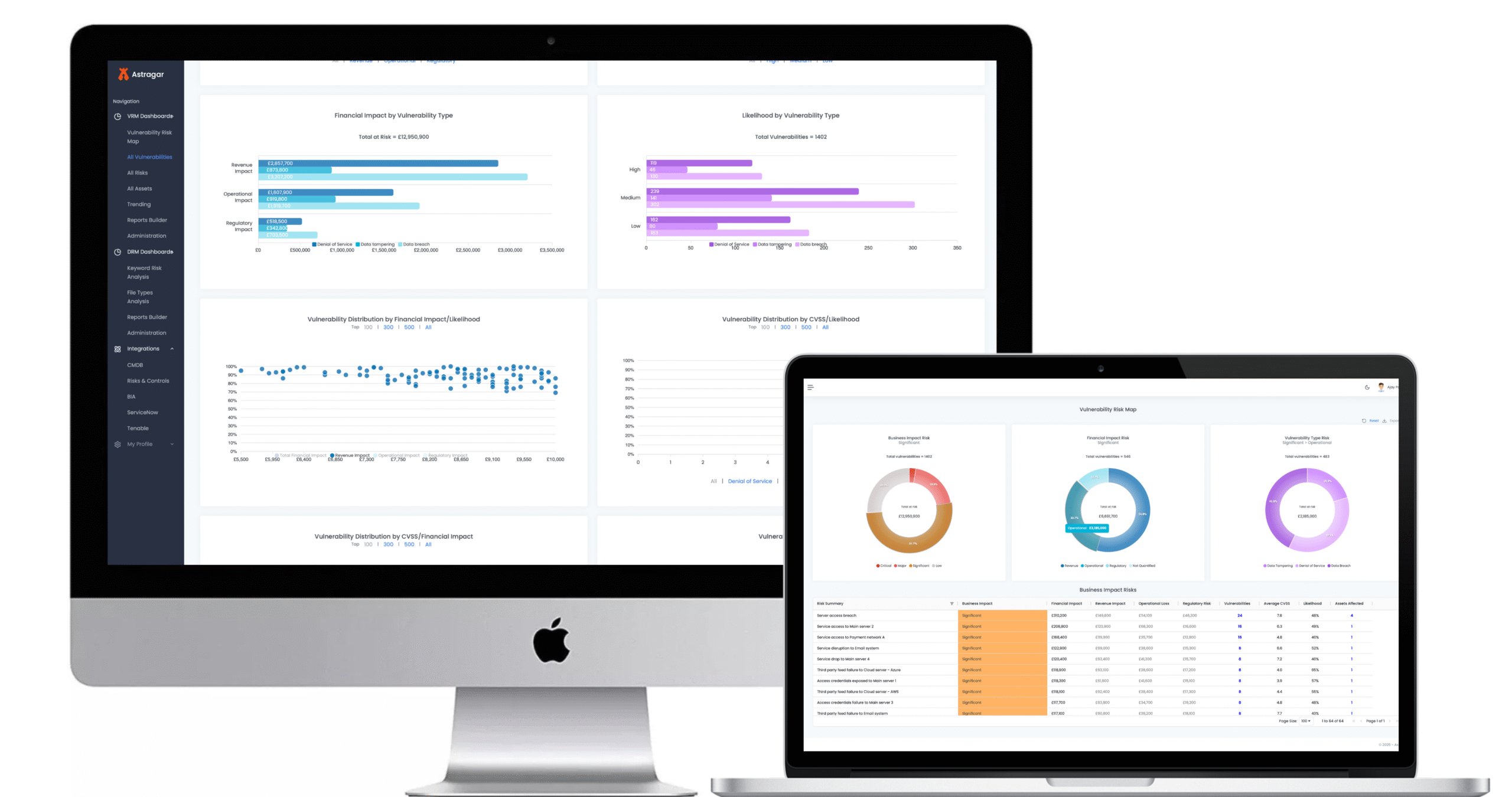

Join us as we redefine how businesses quantify and prioritise cyber vulnerabilities—bridging security, compliance, and financial impact.

Working protype for cyber vulnerabilities

MVP with a U.S. customer

Early interest from banks and reinsurance firms

Target Raise £1,000,000 | Min Investment: £50,000

AI driven platform under development

Soaring cyber insurance premiums + regulatory pressures

• Target Raise: £1,000,000

• Min. Investment: £50,000

• Round: Seed / Pre-Revenue

• Use of Funds: Product build-out, pilot delivery, go-to-market scale

This opportunity is aimed at early-stage investors who understand the high-growth potential—and corresponding risks—of startups in deep tech and cybersecurity. We welcome angel investors, HNWIs, family offices, and others passionate about shaping the future of cyber risk management.

We are in the process of applying for SEIS/EIS advance assurance to make the opportunity tax-efficient for eligible UK investors. Please get in touch with us for the latest status or to register your interest.

Prototype developed for cyber vulnerability management

MVP for data risk quantification validated by a U.S. bank

Early-stage pilots with a global French bank and a reinsurance firm

100+ qualified enterprise prospects in our sales pipeline

Advisor and partnership conversations underway with industry leaders

Absolutely. We welcome meaningful conversations with prospective investors. Please book a call here or email us directly at investors@astragar.com, and we’ll arrange a one-to-one with one of the co-founders.

This communication is intended only for investment professionals and individuals who qualify as high-net-worth or sophisticated investors under UK law. Please seek independent financial advice before making an investment

Join us as we redefine how businesses quantify and prioritise cyber vulnerabilities—bridging security, compliance, and financial impact.

© Astragar 2025 | All Rights Reserved